Black swans, the debt ceiling and Obama’s refusal to #MintTheCoin (June redux)

by pdxblake

The GOP has officially caved in on the debt ceiling debate, supporting a 3-month extension that would require the senate to pass a budget. Paul Krugman says, “Obama was right” in a blog post:

I’m happy to concede that the president and team called this one right. And it’s a big deal. Yes, the GOP could come back on the debt ceiling, but that seems unlikely. It could try to make a big deal of the sequester, but that’s a lot more like the fiscal cliff than it is like the debt ceiling: not good, but not potentially catastrophic, and therefore poor terrain for the “we’re crazier than you are” strategy. And while Republicans could shut down the government, my guess is that Democrats would actually be gleeful at that prospect: the PR would be overwhelmingly favorable for Obama, and again, not much risk of blowing up the world.

I think he is being a bit too positive on the outcome because, yes, while the other options to create havoc by the Republicans would not be nearly as catastrophic, they are still terrible, and it doesn’t necessarily provide vindication to Obama that he was right in this case, as the economist Andy Harless notes on Twitter:

– Krugman says Obama “called it right” (i.e. GOP was bluffing on debt limit). Not sure an ex post right call constitutes responsible policy.

– If there was a 20% chance they weren’t bluffing, was it worth taking off the table all options for dealing with that 20% outcome?

– Calling the GOP’s bluff is like owning an asset with a positive median return but a long left tail. Yes, it usually pays off.

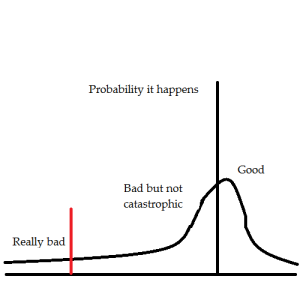

The idea he is saying about the asset example can be demonstrated by this terrible thing I just made in MS Paint. The median return (the size of the area to the right of the black line) is positive. However, the left tail being much longer than the the right shows that there is a possibility (even if it is small) that a really bad outcome could happen (20% of the space under the curve is to the left of the red line). This represents the probability that the GOP was not bluffing and was prepared to force a default, which would be really bad, much worse than the median outcome is a good outcome. Everything else (like letting the sequester kick in, but preventing default lies somewhere between the black line and the red line).

The principle behind his argument is that just because the expected value of his “call their bluff” strategy was positive, it was not a good strategy for Obama to rule out his other options (like the platinum coin, or other options). This question is an example of the difficulty in dealing with Black Swan events (of which the financial crisis is a notable example). Since this is a blog and not something more formal, I can cheat and cite Wikipedia’s definition of why a Black Swan event is hard to manage:

- The disproportionate role of high-profile, hard-to-predict, and rare events that are beyond the realm of normal expectations in history, science, finance, and technology

- The non-computability of the probability of the consequential rare events using scientific methods (owing to the very nature of small probabilities)

- The psychological biases that make people individually and collectively blind to uncertainty and unaware of the massive role of the rare event in historical affairs

For (1), there has not been a US government default, or historical examples of the country coming close to default for the past 150 years, except for the fight in August 2011 over the debt ceiling, which is an awfully small sample to use to develop conclusions for future policy. As a result of (1) and the limited amount of control that John Boehner has over the extremist elements of the GOP House makes predicting probabilities that the debt ceiling would not be raised very hard. And for (3), because the US government has never defaulted on its debts on the Federal level, and because US Treasuries are considered a ‘risk-free’ asset in all the models used for pretty much the entire world, it is impossible for anyone to understand how important the ‘risk-free’ nature of US Treasuries is to the global financial system (and thus makes a ‘mistake’ by the House GOP more likely because it creates a psychological bias that blocks the comprehension of how damaging it would be to allow the US government to default).

Why rehash the theory behind whether Obama was playing with fire with the House GOP? Why not move beyond banging ourselves in the head with a hammer and start thinking about more positive policies that could help the economy? Well, because it’s not necessarily over. Business Insider quotes a GOP aide in the House with three possible outcomes during the 3-month break from the current crisis:

1. Dems decide to make their stand here and refuse to pass anything that is short term or tied to the requirement for the Senate to pass a budget. If this happens, things get ugly fast. You get the same war all over again and Republicans will likely feel more righteous about their resistance given the Dems unwillingness to take on what (the GOP sees as) very moderate reforms.

2. Dems agree to pass a budget and the three month extension kick the debt ceiling to around June. That means the hard line anti-spending guys can make their stand on both the CR in March and all the FY14 appropriations bills between now and June. That should function as a great pressure release valve for leadership to force through what will likely be a less-than-palatable long-term debt ceiling extension.

3. We get a short term, but without the budget reform or the Senate never actually passes a budget. CR becomes extra contentious, approps bills turn into the same type of go around as HR 1 and then the debt ceiling arrives with a unified, very angry right wing of the party. Back to things getting ugly, only worse.

The short-term increase is contingent upon the Senate passing a budget, upon threat of having their paychecks withheld, which might be unconstitutional (according to House member Daryll Issa earlier this afternoon before his party got to him and he changed his mind). That’s not hard, the Democrats control the Senate, you say. But wait, the Republicans filibuster everything they don’t like and the Senate still has not yet made any changes to the filibuster.

So, for as relieved as everyone is today that the era of crisis is over, it might not be. If everything falls apart, we’re back to square one with the debt ceiling in May or June instead of February or March and, if things move along the lines of Scenario 3, Obama may be wishing he had not said he won’t #MintTheCoin or use the 14th Amendment to bypass the debt ceiling (or may try to wiggle out of his pre-commitment not to use them. Let’s hope it doesn’t come out this way.